How Do Wind and Hail Claims Work for Houston Roofs?

By Shantell Moya · 5 months ago · 12 min read

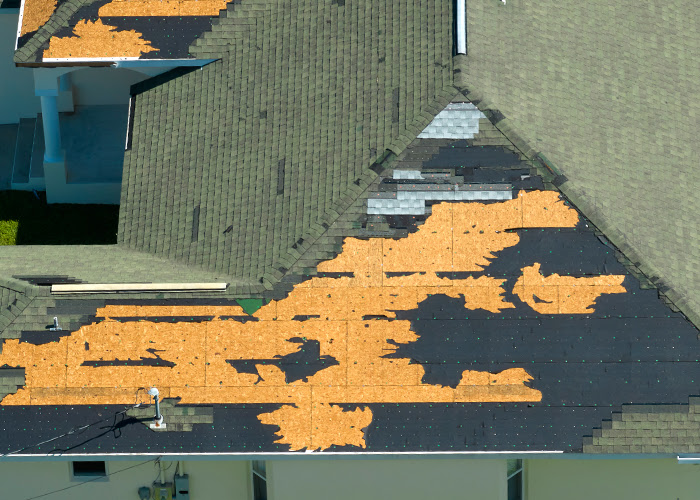

Houston homeowners already know what happens when grapefruit-sized hail starts coming down or when 70-mph winds start tearing shingles from roofs – you can hear the damage happening in real-time. The financial stress can weigh on you when your home takes this kind of beating from major weather.

NOAA data shows that Harris County is near the top of the list nationwide for storm-related property losses. Those statistics become very real when it’s your own roof that needs replacing. If you want to get every dollar you deserve from your insurance company, you’ll need to understand your policy language and know what steps to take when the adjuster shows up at your door. Most homeowners end up losing thousands of dollars because they don’t understand their rights under Texas insurance law.

I’ll walk you through documenting your damage the right way and the entire claims process from beginning to end – all without the confusing insurance terms, starting with the biggest first step you need to take right after the storm moves through.

How to Check Your Roof After a Storm

Your roof just went through a bad storm, and you need to check what got damaged up there. You need to move fast because it’s best to check for damage within 24 to 48 hours after the storm passes. Insurance firms track weather events down to the hour. Your claim will be much stronger when you write down and photograph everything while the storm is still fresh in everyone’s mind.

You don’t want to get hurt while dealing with roof damage. It’s safer to stay on the ground and use binoculars to look at your roof from different angles around your house. You can see most of what you need to see from the ground anyway. Drones work even better if you have one or can borrow one.

Look for obvious problems like missing shingles or dents in your gutters. Make sure to check inside your house, too, because water stains on your ceiling are obvious signs of roof damage. Insurance adjusters know just what those brown marks mean.

When granules come off, they leave bare areas on asphalt shingles that look like dark patches. Wind damage shows up as cracked or curled shingle edges where air got underneath and lifted them. If your gutters and downspouts have dents, the hail probably hit your roof just as hard.

When you do find damage, take detailed photos. Put a quarter next to hail dents when you take photos since coins help adjusters understand the size immediately. Adjusters see thousands of damage photos each year. You should also look up the actual wind speeds from the National Weather Service for your area and write them down.

Take photos with timestamps turned on, and don’t throw away any broken shingles until after your insurance company sees them. You might think that busted shingle is trash. But it’s actually proof you need to keep around. The actual broken pieces help prove your claim when adjusters come to your property. Broken shingles show the exact material and color, so they know what needs to be replaced.

What Your Policy Says About Wind Damage

The fine print in your policy can make the difference between having a claim covered and paying for expensive repairs yourself. Most homeowners never actually read through their policies until something goes wrong. They usually find out about the problems at the worst possible time.

Named-peril policies will only cover specific events that are listed in your contract. Comprehensive coverage protects you from everything except what’s specifically left out. The difference matters when you’re trying to prove that your damage came from wind instead of just general wear and tear. The type of coverage you have changes your entire claims experience right from the start. Named-peril policies mean you have to prove that your damage matches something on their approved list. Comprehensive policies mean the insurance company has to justify why they’re saying no instead. Your settlement amount will usually depend on which type of policy you have.

Texas now requires at least a 2% wind and hail deductible on most policies. What that means is that if your home is worth $300,000, you’ll need to pay $6,000 out of your own pocket before your insurance starts paying anything. Some insurers offer percentage deductibles that reach 5% and can save you some money on premiums but will cost you more when something bad happens.

The age of your roof matters more than you might think. Many policies will exclude or limit coverage for roofs that are over 10 or 15 years old. If you have a 20-year-old roof, it might only qualify for actual cash value instead of the full replacement cost. When your roof gets older, depreciation calculations automatically kick in and lower your payout. Insurance companies use age-based formulas that can cut your settlements by thousands of dollars. Plenty of homeowners only find out about these reductions after they file their first big claim. Your policy will cover the damage, but you’ll still be responsible for making up the difference from depreciation.

The 2017 Johnson v. State Farm Lloyds case clarified when cosmetic damage should count as functional damage. Cosmetic problems like granule loss might not be enough to get coverage. But functional problems like leaks should be covered. This difference usually ends up being the main argument when claims get disputed. Actual cash value pays you what your old roof was worth after taking out depreciation. Replacement cost coverage pays to install a completely new roof. The difference between these two can be thousands of dollars, especially if you have an older home.

How to Meet the Insurance Adjuster

When you see damage on your Houston roof, you need to act fast. Texas insurance policies usually give you one year to file a claim after a storm hits. If you miss that deadline, you won’t get any money at all. That year goes by much faster than you might think.

The first step is pretty simple, but it matters a ton. Call your insurance company as soon as possible to open a claim and get your claim number. While you’re waiting for the adjuster to show up, you should take photos and videos of every damaged area. Your phone camera works just fine for this. Try to capture everything you can see from the ground level and any damage inside your home, like water stains on the ceiling.

Here’s where most homeowners in Houston make their biggest mistake. They wait for the adjuster before they do anything else. But what you should do is contact a local roofing contractor as soon as you can to get an estimate. When you have that estimate ready before the adjuster arrives, it gives you something to work with during their assessment.

Your contractor’s estimate is going to be your best tool here. Insurance adjusters work for the insurance company, not for you. Your contractor’s assessment shows what repairs cost in your local market. This gives you a baseline that forces the adjuster to explain any lower numbers they might propose.

You want to be there in person to point out every problem area and ask questions about their process. If you can join them on the walk-through, that’s even better. Ask them to explain any damage they dismiss and watch to make sure they write down everything correctly.

The adjuster will then compare their findings to your contractor’s estimate. That’s when the real negotiation begins. Everything you did to get ready and document during these early steps is going to make the difference in whether you get a fair settlement or end up fighting about it later on.

Without proper preparation, you could lose thousands of dollars in denied coverage. Insurance companies count on homeowners who show up unprepared and accept the first offer they get.

How to Get a Fair Insurance Settlement

When you get your claim check, it doesn’t mean everything is settled. Most insurance firms send out adjusters who work fast and sometimes miss important parts that matter – they care more about speed than being careful. You need to compare their estimate with what local contractors in your area actually charge for the same work.

It’s worth looking closely at the line items in your adjuster’s report. Insurance firms shortchange homeowners on materials like flashing and underlayment costs. These materials help protect your roof from future leaks. But adjusters will usually lowball the prices or leave them out completely – these are always the first items they cut.

Once you find these gaps, you can ask for a supplement to your original claim. Supplements give you another shot at receiving fair payment for work the adjuster missed. Your adjuster made some quick decisions during that first inspection. But you’re the one who’ll live with the results of incomplete repairs for years to come. Don’t feel bad about asking for more money when the adjuster got it wrong the first time. The Texas Department of Insurance keeps track of these kinds of disputes, and homeowners win more than you’d think.

The whole process becomes overwhelming when you’re already dealing with tarps on your roof and trying to keep your normal life going. Policy documents read like another language, and insurance firms want you to make decisions fast. Your roof needs proper repairs while you’re trying to understand complicated documents and meet tight deadlines. If you make hasty decisions now, you’ll be stuck without enough coverage long after the emergency is over.

Sometimes, it makes sense to hire a public adjuster, even though they take a percentage of your settlement. They know how to spot when you’re not receiving enough, and they speak the insurance company’s language. These experts work for you, not for the company’s profit margins. Other times, you might need to use your policy’s appraisal clause instead of going straight to court.

What You Pay for Deductibles and Cosmetic Damage

Houston homeowners are dealing with a harder situation now when filing roof claims. The insurance industry has changed in ways that make getting money for wind and hail damage tougher. Your roof might get the same damage as your neighbor’s roof. But how much you’ll pay out of pocket comes down to the policy fine print that most people never actually take the time to read.

Most insurers now use percentage deductibles instead of flat dollar amounts. What that means is your out-of-pocket costs are based on how much your home is insured for. Let’s say your house is insured for $300,000, and you have a 2% deductible – you’ll need to pay $6,000 before your insurance starts paying anything. It’s basic math. But the results can get very expensive. Lots of insurers have been raising their deductibles from 1% to 2% over the past few years.

And then you run into the whole cosmetic damage problem. Insurers love to call hail dents “beauty marks” and turn down claims, saying the damage is cosmetic. They’ll tell you that dented shingles still work just fine, even though they look terrible. Nobody wants to pay thousands of dollars out of their own pocket just because an insurance company says your roof damage is cosmetic. These cosmetic exclusions mean homeowners have to pay for every repair themselves while their premiums stay the same.

Hurricane Harvey made the whole situation even worse. After 2017, named-storm surcharges started showing up everywhere, and some insurers now split up “appearance loss” from “performance loss” in their policies. You could see this coming from a mile away. Deductible costs have gone up way faster than premium increases. Premiums stay about the same while the amount you pay out of pocket keeps going up because insurers have pushed more of the financial burden onto you.

Texas law throws in another complication. It’s against the law for contractors to waive your deductible, and the state started cracking down harder on this after they passed HB 2102 in 2019. Some insurers do have roof upgrade endorsements or give you discounts for upgraded roofs that can help bring down your costs. But if a contractor tries to help you with your deductible, you and your contractor could end up paying state penalties.

A Secure Home Starts with a Solid Roof

When you need to go through the wind and hail claims process, it’s natural to feel a bit overwhelmed. But if you break it down into smaller steps, it does make a big difference. From the first time you notice damaged shingles all the way to when you finally get that settlement check in your hands, each phase builds on the one before it. At the end, you’ll have the comfort that comes from understanding your family’s shelter is safe again.

Storm damage creates stress that goes way past roof repairs. The secret to success is all about preparing and taking action. It’s worth taking some time to double-check your deductibles and know if you have replacement cost or actual cash value coverage. Most people never bother with this. When the next Gulf Coast storm warning pops up on your weather app, just remember to take pictures immediately, read everything carefully, and negotiate wisely. This approach will serve you well with a small leak or major structural damage.

Insurance adjusters respect homeowners who know what their coverage includes. Your organized way of handling everything shows that you mean business.

Storms are going to keep rolling through Houston – that’s just part of living in this beautiful city that happens to get some rough weather. But when you’re prepared, you can turn what could be total chaos into straightforward paperwork and next steps. And for protecting your biggest investment, knowing what you’re doing makes the difference.

Your home’s protection impacts everything from how well you sleep at night to where your family gets together for holidays. When you get ready properly, you can weather future storms with confidence instead of worrying about them constantly.

Speaking of which, if you have a trusted roofing professional on your side, the whole process goes much smoother. At Roof Republic, we specialize in commercial and residential roofing throughout the Greater Houston Area, covering Magnolia, Tomball, Cypress, and Conroe. We understand how insurance claims work, and we’ll take the right pictures of damage from day one.

Contact us for a free inspection, and we’ll help you protect your investment with the professionalism it deserves.

Comments

Sort by: